ABSTRACT

The view from Emirates, Etihad and Qatar Airways headquarters has stroked fears into the hearts of rival airline companies around the world especially in Europe and North America. Well, why not, the rapid growth of these airlines has been phenomenal and the markets they have captured are beyond expectations. As these three airline companies are growing so as their hub and therefore more passengers handled by these airports every day in coming years. This is good news for them (Emirates, Etihad and Qatar Airways) and for their passengers who will have some great services on the way to and from their destination. With, every good news, there is a bad news waiting; but the bad news is not for these airline companies but for their rival companies in Europe and North America. The objective of the study will relate to some of the information regarding these 3-airline companies? expansions and it sought to examine more closely the implications on consumers and their rival airline companies in Europe and North America. In addition to that, the report outlines some of the appropriate strategic options about Emirates, Etihad and Qatar Airways in order to keep itself economically sustainable. Different sources are used in order to execute this report.

INTRODUCTION

Airplanes, a bird with engines fly through the air has developed in less than a century.? Commercial aviation is an important industry around the world and over the years, aviation has perfected itself from a simple glider to space shuttles. Commercial aviation is highly competitive in the world due to the arising costs of operation and maintenance and as people travel for leisure and business, and airplanes are most reliable mode of transportation. The Airline industry is one of the world is largest growing industries, which has generated over $300 billion in 2001 single-handedly and in addition to that it has the second highest industrial growth rate, after the software (computer) industry, with standard growth rates of 3% ? 5% per annum over the last 20 years (Airliner World, 2012). The introduction of new jet planes such as Boeing 707 and DC-9 at the late 1950 has brought a new era in the commercial aviation, which is known as ?The Jet Age? (?The Era of Commercial Jets?, n.d.). In 1927, Charles Lindbergh successfully completed his first solo flight across the Atlantic Ocean and created a massive interest in flying with the public. Since then, air travel grew rapidly until 2001 expanding at a number of 172 million passengers in the year 1970 to approximately 642 million passengers in 2003 (?The Era of Commercial Jets?, n.d.).With the production of jets in the commercial aviation, airline companies revolutionized their short routes; the structure of civil aviation air management and ground operations changed tremendously with the introduction of jet planes in the commercial aviation industry (?The Era of Commercial Jets?, n.d.). Air travel has grown in the past decade and it keeps on growing rapidly for both leisure and business purposes. This also affected the short routes and had some social effects on people worldwide. With the growth of air travel in past decade travel grew simultaneously strongly for both leisure and business purposes. Elasticity of demand, externalizations, wage inequality, monetary policies and fiscal policies extremely influences the airline industry (Aviation News, 2011).

The current market conditions decide the direction of airline industry; recently the International Air Transport Association (IATA) further downgraded its 2011 airline industry profit forecast to $4 billion. This is a disaster as this is a 54% drop compared with the $8.6 billion profit forecast in March and a 78% drop compared with the $18 billion net profit (expectations from $16 billion) recorded in 2010. On predictable revenue of $598 billion, a $4 billion profit will equate to a 0.7% margin (IATA, 2011). The past two years airline industry has seen many disastrous economic conditions, which includes an unparalleled number of airlines, worldwide, filing for bankruptcy and many more, would have followed suit if there was no government intervention (Airliner World, 2012). The main factors leading to their failure and the problems currently faced by the airline industry is very general, they have their roots in the existing economic, and political climate, which is according to IATA (2002), continues to remain very challenging. At first, starting with the Natural disasters in Fukushima, Japan, then the unrest in the Middle East and North Africa (Arab Spring), in addition to that, the sharp rise in oil prices has reduced the industry profit expectations to $4 billion this year. If the industry is making any money annually is a combination of unmatched disasters with a result of a very fragile balance (Airliner World, 2012). The high fuel price affected by the industry is balanced by the efficiency gains of the last decade and the strengthening global economic environment. Even with all these conditions, some airlines have projected an excellent profit rate and increased their load factor unlike anyone (Airports International Council, 2012). Emirates, Etihad and Qatar Airways has become the new face of the airline world, a leader in the industry that has captured different markets and leaving its impression worldwide (Airliner World, 2012).

Throughout the paper, it will discuss some of the questions that will lead to the answers of this research:

1)????? What are the factors, which has made these three airlines so strong and powerful and a world leader in the airline industry?

2)????? What airline companies in Europe and North America needs to do in order to keep themselves competitive to Etihad, Emirates and Qatar Airways?

3)????? Can Etihad, Emirates and Qatar airways be this economically sustainable in the future?

INTRODUCTION-THE BEGINNING

On 1971, most of the Persian Gulf countries marked their independence from Great Britain. During the year from 1951 to 1971, a British company; BOAC (British Overseas Airways Corporation) became one of the major shareholder in the Gulf Aviation, holding about 22% stake in the company (Gulf Air Company, n.d.). The company Gulf Aviation began its services to London on April 1970 with a regular aircraft (Vickers VC10) then, with the beginning of BOAC, saw a sequence of updated aircraft entering the fleet (Gulf Air Company, n.d.). The greatest turning point for Gulf Aviation came after 1971 as most of the Persian Gulf countries got their independence and from these; the governments of Kingdom of Bahrain, State of Qatar, the Emirate of Abu Dhabi and Dubai; and the Sultanate of Oman purchased BOAC?s shares in Gulf Aviation (?21st Century?, 2008). On January 1, 1974 under the Foundation Treaty created a national carrier of the four Gulf States and named it ?GULF AIR?. Then, in 1983, Gulf Air was startled with two big blows on itself (?21st Century?, 2008). ?Then later in June 1980, the UAE Federal Government was proposing to set up a national airline, which will compete with Gulf Air. The Federal Cabinet asked the Emirate of Dubai and Sharjah to carry on with the proposal under the open skies policy in the region (?21st Century?, 2008). In a very grouchy stir, both the Emirates (Dubai and Sharjah) refused to recognize Gulf Air as the national carrier. Moreover, the worrying factor came in, as State of Qatar who was one of the important shareholders in the company was also interested in starting its own Airline Company (National Carrier) (Gulf Air Company, n.d.). Therefore, in 1993, Qatar started its own national carrier: Qatar Airways and almost after nine year on 2002, the Government of Abu Dhabi also withdrawn its shares from Gulf Air and started its own carrier Etihad Airways (?Gulf Air welcomes.? 2009). On 1993, the Government of Oman also founded its national carrier ?OMAN AIR? and later became a joint stock company and purchased 13 aircrafts of Gulf Air. Currently, Bahraini government solely controls Gulf Air and it is the national carrier of Bahrain with its headquarters in Manama, Bahrain (?Gulf Air welcomes.? 2009).

Emirates Background

Emirates airline (also known as by marketing phrase Fly Emirates) is the national airline of the Emirate of Dubai, United Arab Emirates. It is one of the largest airline companies in the Middle East including in the Persian Gulf and it operates more than 2400 passenger flights per week from its hub Dubai International Airport Terminal 3 to world?s 105 cities in 62 countries across six continents (IATA, 2011). The company also operates three of the ten world?s longest non-stop moneymaking flights from Dubai to Los Angeles, San Francisco, New York and Houston (Skytrax, 2011).

Anyhow, everyone has a humble beginning so did Emirates, Emirates started its first operation out of Dubai with just only two aircrafts?- a leased Boeing 737 and an Airbus 300 B4 from Pakistan International Airlines in 1985 (Borenstein, S. 1992). As mentioned in the beginning, the Government of Dubai wanted to have its own national carrier and so separated it from Gulf Air. Due to this decision taken by government of Dubai, a tense relationship was created between the government and the airline, in reaction to that Gulf Air reduced the flight frequencies and capacities to and from Dubai between two thirds between the year 1984 and 1985 (Borenstein, S. 1992). Emirates have focused its differentiation in a legacy airline of luxury, high tech, state of the art and its excellent quality. It has been very successful in its operations, it is Gulf?s largest carrier, and one of the world?s largest airline company and expected to be the world?s largest airline by 2015 (?Aviation in the Gulf?, 2010).? Since the foreign airline companies were unable and unwilling to fill the gap, therefore ruler of Dubai, Sheik Mohammad Bin Rashid Al- Maktoum convened a team of experts headed by Maurice Flanagan and Tim Clark and later the son of the Dubai?s ruler, Sheik Ahmad Bin Saeed Al Maktoum to deal with the emergency. However, there were two conditions by the ruler: First, the airline should meet the highest quality standards as possible and there would not be any additional capital injections by the government other than the promised US$10 million startup capital (Emirates, 2012). ?With few destinations in the beginning on 1985 (Dhaka, Colombo, Amman and Cairo), by 1987 it added first two European destinations- London Gatwick and Frankfurt. Later, in 1995, Emirates started to operate all wide body fleet and in 2001, 2003 and 2005 Emirates placed some of the largest aircraft orders ever (Emirates, 2004). ?Since 1985, Emirates airlines entered in the industry it improved its operations, they rapidly increased their size, recruited more people and added more destinations each year. With all these improvements lies some sources of competitive advantages for Emirates Airlines, they have provided some operating efficiency compared to other flag carriers or foreign airlines. Now there are direct (non-stop) flights from New York to Dubai twice daily and this means that Emirates has succeeded in providing quality, innovation and efficiency that is considered as the building blocks of the competitive advantage (J. Johnsson, 2007). The second source of Emirates competitive advantage is its low fares and since cost is one of the important factors that determine the competitive advantages among rival companies and beat the competitors out of the market. Emirates airline has captured almost every market with its great service and lower fares, for example: flights within South America; Buenos Aires to Rio De Janiero one way is only US$290 compared to TAM, Pluna and LAN, which is US$350. In addition to that, the service by Emirates is phenomenal, legroom and above all the baggage allowance (2 bags per person) compared to others only one bag policy (Emirates, 2012). ?For its long- haul flights, Emirates provides layover in Dubai with free hotel and airport transfer whereas other airlines could not provide it as it increases their costs. Some of these benefits keep Emirates very competitive in the Aviation Market. Another factor, which is an advantage for Emirates against other carriers in the industry, is the family based structure. Additionally, they do not have as strict governance practices like in the Western companies; their distinctive characteristic is that unlike most other airlines in the industry. They do not have a board but do regular meetings on Wednesday. One thing about Emirates is that ?Sky is no more the limit!? (J. Johnsson, 2007).

QATAR AIRWAYS BACKGROUND

Qatar Airways is the national carrier of Qatar and its headquarters is in Doha, Qatar. One of the top airlines in the Middle East, in fact according to Skytrax 2011 Qatar Airways has been ranked no. 1 Airline in the industry and one of the four airlines, which has been given Five Star Statuses (Skytrax, 2011). Furthermore, it is also a member of the Arab Air carrier?s organization; Qatar Airways story starts in a similar fashion like Emirates. Qatar Airways was established on November 22, 1993 but it started its flight operations on 20 Jan 1994. At the beginning, Qatar Airways was completely owned by the Royal Family of Qatar (Government) and it started as a low fare airline company. As Qatar was, also part of Gulf Air (national carrier) and it got the idea about establishing its own national carrier after Emirates been successful (?Aviation in the Gulf?, 2010).? At the beginning, Qatar Airways used wet leased Boeing 767-200 aircrafts from Kuwait Airways (owned by Qatari royals), however it was re-launched in 1997 as Qatar Airways. On February 1 1999, Qatar Airways had their first delivery of Airbus A320 aircraft on lease from Singapore Aircraft and on May 2002, the Government of Qatar withdrew its shares from Gulf Air completely and at that time, Qatar Airways had 21 aircrafts (Gulf Air Company, n.d.). Currently, the government of Qatar controls 50% of the stake at Qatar Airways and 50% by private investors. Qatar Airways also ordered new Airbus A380s and A340 on January 11, 2011. The operations of the company have not reached as far as Emirates but currently they are operating more than 80 destinations all over the world but on June 27, 2007 (TNN, 2009). As, Qatar Airways began its services to New York, it has marked its long haul flights; it will also be serving more US cities and South American cities. Qatar Airways has also trying to capture the market in South America like Emirates, which would be an interesting scene as both the Gulf Based Airlines competing with each other in order to control the market. (R.Balakrishnan, A. Fadnees, 2012).

As the company is operating on a very competitive market but known for its large capital base and a growing fleet size, it is becoming a threat to its competitors. In realizing the benefits of the industry, Qatar Airways as one of the participants in the fleet industry is expecting to expand its operations in more destinations and in all continents just like Emirates. With its expansion in process, some relevant strategies are required in order to keep it profitable and sustainable; in short, this is an industry where competitiveness should be first attained at all level (R.Balakrishnan, A. Fadnees, 2012).

ETIHAD AIRWAYS BACKGROUND

This is one of the airline companies, which was born with golden spoon on its wings. It was established by a royal ruling on July 2003 but its first flight commenced on November 2003 with a ceremonial flight from Abu Dhabi to Al Ain, a small city 160 km (125 miles) east of Abu Dhabi and 120 km (95 miles) south of Dubai. Just like Emirates (Government of Dubai) and Qatar Airways (Government of Qatar), the government of Abu Dhabi was also part of Gulf Air; it was also the national carrier of Abu Dhabi. Etihad is the national carrier of United Arab Emirates, so it is company?s Slogan ?From Abu Dhabi to the World?, and pretty much, it is doing it. Etihad means ?United? and it portrays the unity and goodwill between all the Emirates of United Arab Emirates (Adam Schreck, 2012).

Etihad has been one of the fastest growing airline companies and it has increased its destination and routes rapidly; almost ten to twelve routes every year and its fleet size. Etihad has announced the largest aircraft order in aviation history at International Air Show on 2008, it was up to 205 aircraft. By May 2010, the airline started services to more than 61 destinations around the world from its hub Abu Dhabi International Airport (Adam Schreck, 2012). The Airline is currently operating more than 1200 flights per week with over 82 destinations in more than 50 countries with a fleet of 66 Airbus and Boeing aircrafts. Etihad introduces a major campaign every year and invests seriously on marketing as the marketing department as the marketing is an important part of the industry. The Marketing department in Etihad has three divisions: Sponsorship and Exhibitions, Brand Management and Visual Communication (PTI, 2008, July 15). In the year, 2010 Etihad carried more than 7 million passengers compared to 6.2 million passengers; now this is a 13% increase for the airline. In spite of all the record revenues by the airline, which was US$300 million in 2010, unfortunately Etihad has not yet been profitable but recently on 2011 Etihad has claimed to have a full year profit. As Etihad posted a 39% jump in its third quarter revenues and increased its network and passenger numbers (PTI, Jan 26, 2012). On the year of 2012, Etihad has invested in many other airline companies like Virgin Australia and Air Berlin. On 5 June 2012, Etihad invested almost in 4% of the stocks of Virgin Australia and recently when Air Berlin was almost bankrupt, Etihad injected its wealth. Since its beginning in 2003, Etihad Airways has received more than 30 awards; it was also the winner of World Travel Awards (WTA) for having the best Business Class in the world and for its outstanding service in 2009. In addition to that, on November 2009 Etihad Airways won the ?World Leading Airline? award. In 2010, Etihad was awarded as the ?World?s Best First Class?, ?Best First Class Catering?, ?Best First Class Seat? and for consecutive years it has been awarded as ?World?s Leading Airline? by Skytrax.

| ? | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010?? |

| Number of passengers (millions) | 0.1 | 0.3 | 1.0 | 2.8 | 4.6 | 6.0 | 6.3 | 7.1 |

| Number of aircraft (at year end) | 6 | 12 | 22 | 37 | 42 | 52 | 57 |

After the background of the three airlines, it is important to know more about these Airlines Economic Forces, Key Success Factors, SWOT analysis and above all the Economic Recession Strategies.

ECONOMIC FORCES OF

QATAR, EMIRATES & ETIHAD

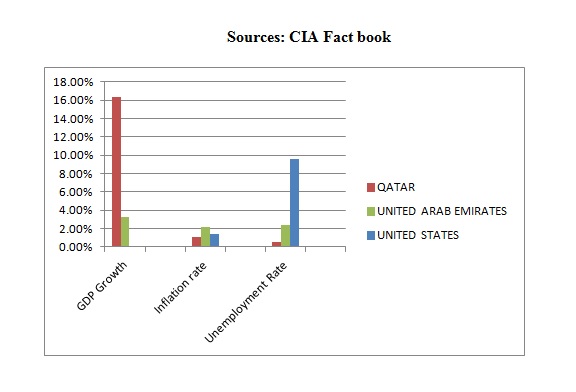

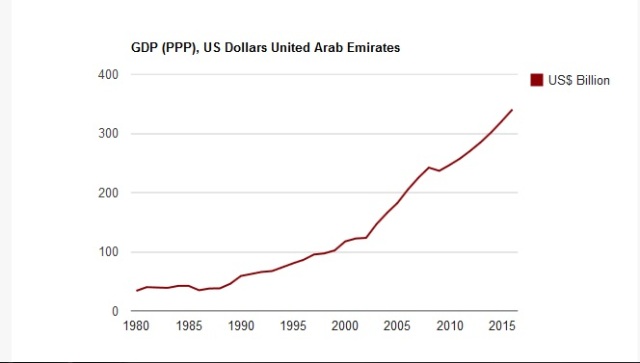

In the airline, industry demand for travel extremely depends on the economic conditions, an organization?s marketing strategies. Qatar, Etihad and Emirates has grown and developed its business in their home cities (Abu Dhabi, Dubai and Doha). The economy of these three cities or the two countries (Qatar and United Arab Emirates) is very strong. In fact according to Forbes, World richest country of 2011 was Qatar with a GDP of US$88,222 per capita whereas United Arab Emirates being the sixth richest country with a GDP of $47,439 per capital just slightly above United States of America (CIA FACTBOOK, 2011). Unquestionably, a stable economy and sustainable wealth is a key to success and an increase in the demand for air travel whether it is for business or leisure. With recent economic crisis Emirates, Etihad and Qatar airways has shown a lot of revenues and profits which unfortunately many other rival companies in Europe and North America (United States) have not posted. Demand is deteriorating, as the economic conditions look grim around the world; now the challenge is how to survive this crisis but for these three airline companies it does not look that grim as it is government sponsored airline companies and enough wealth to inject it does not seem much trouble for these three airlines in the present.

Another factor employed by these three airline companies is diversity; both of its domestic and international markets Emirates, Etihad and Qatar operate in a cultural diversity. U.S.A., U.K., Canada, Australia and other parts of Europe where it is a melting pot and there are variety of consumers and as most of the, stable incomers; this gives these three airlines to cash in with strong demand for travel on holidays (?Middle East Airlines?, 2011).

Below is the profile and data of these two countries compared with United States of America:

?

| UNITED STATES | QATAR | UNITED ARAB EMIRATES | ||

| GDP Growth | 2.?8%? | 16.30% | 3.20% | |

| Inflation rate | 1.40% | 1.10% | 2.20% | |

| Unemployment Rate | 9.60% | 0.50% | 2.40% | |

?

?

?

?

?

?

?

?

?

DUBAI SUNSET

?

?

DOHA, QATAR : A new city on the rise

ABU DHABI: ?New York of Middle East

Porter? Five Forces

?

?

Whenever there is a profitable market, more firms that are new will enter the market to establish itself. Asia Pacific is one of the great examples for this; it is the region of a vibrant market where an inbound tourism enjoys a growth of 7.9% and outbound with a 25%. All the airlines operating in this region during the financial crisis were having high profits; for example- Qantas profits were US$618 million in 2007, Cathay Pacific profits on 2007 were almost US$905 million. In this situation Emirates, Etihad and Qatar airways exploited the market for high profitability as demand was growing.

?

?

Emirates, Etihad and Qatar Airways compete with some of the largest airlines in Europe and America: Air France, KLM, Lufthansa and United Airlines. As these well-established airline companies are operating the same destination in Asia Pacific, Australia and America, the competition is so aggressive that the global industry is witnessing a growth of low cost airlines.

?

?

As competition between the companies are becoming intense, Emirates Etihad and Qatar Airways may face a threat now and in future when customers have an ability to make demands on their products in terms of lower prices, a phenomenal service and great product quality. Therefore, these three airlines are unlikely to exhibit high rates of return (turnover) due to price reducing and investing more in the product innovation.

?

- Suppliers Bargaining Power

?

World?s dominant aircraft producers are Airbus and Boeing and every other airlines places orders with the, as a large buyer these three airliners still faces a threat of paying higher prices or even delivery delays. Furthermore, they also depend so much on these suppliers as required products and are differentiated while the suppliers have high proficiency.

?

?

Most airliners offer similar products with similar features: Low Price, outstanding quality,

and phenomenal service. In other regions, there are some direct substitute products to Emirates, Etihad and Qatar Airways. There will be challenges for these three airlines when there will be enough competition to launch new products globally. For Example: Virgin Atlantic has its subsidiaries around the world: Virgin America in United States, Virgin Australia in Australia and Virgin Nigeria in Nigeria and its nearby regions. Consumers (Passengers) will benefit from these low fares and higher quality; in addition these products will meet the customer demands and understand what they want.

Key Strategies Employed

?

Reviewing these three airlines business strategies, one can understand its focused differentiation as a five star airline or ?Airline of the Year? underlines the product development in terms of luxury, excellent quality and outstanding performance (service). These three have proved to be successful companies exploiting the market with high profitability. Secondly, none of these three airlines is in the major alliances (Star Alliance, One World Alliance and Sky Team). With these competitive markets, will they be able to compete with the big giants?

Unambiguously, this explains how strategic the management is and they consider the possible impact of entering the major alliances with their strong competitors of similar level economies of scale, operating within the markets and channels.

Key Success Factors

?

?

It is very important for good managers to cut costs and increase the revenue and it is vital for capital-intensive industry such as in the airline industry. For these three airlines to balance the total operation costs, the management must work very to costs and keep profits high. According to my own experience, this year on January when I was traveling from Abu Dhabi to Doha and later Doha to Zurich, it was shocking that Qatar Airways and Etihad Airways on these flights were 30% empty. In this recession economic situations these scene would not be seen on any other airlines (J. Wensveen, 2007).

?

?

Emirates, Etihad and Qatar Airways are well ? established companies with strong alliances over international destinations and other the other hand they keep on continuing to invest on new fleets. This means they will increase their capacity and maintain fixed costs with other players. They will access the global market with greater geographical coverage and this will create a high barrier to new entrants due to high costs and scope of business ?(J. Wensveen, 2007)..

?

?

?

Emirates, Etihad and Qatar are legacy airlines where advanced technology, staff skills, state of the art technology and auxiliary services are the main drivers for success. Therefore, they are aware of the need for continuous innovations, and not only in the fleet and staff expansion but in the premium services for everyone. They have been renowned for technology development and skilled staff of multi culture backgrounds (?Aviation in the Gulf?, 2010).

RIVAL COMPANIES

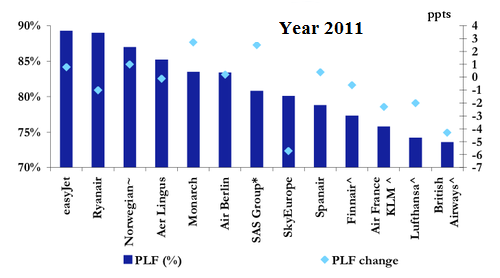

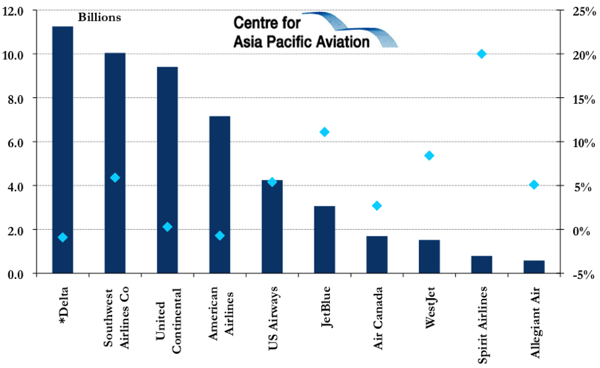

As explained the key success factors of these companies, here are some of the rival companies in Europe and in North America, how they are performing. From the graph and data some assumptions can be done:

?

In Europe, we can see the low fare airline companies are performing better than the international carrier can and a lot of them are merging with each other like British Airways and Iberia, then KLM and Air France. As markets are getting competitive low fare, airlines are trying to capture the market. In Europe because of the EU establishment, there is open sky policy and in addition, most European cities are just few miles away from each other and only maximum 2-3 hours flight from each other. Most passengers do not mind to travel in less legroom and give away some comfort as they are paying a very low price for the tickets.

?

In this graph for the US carriers, it is the mirror image of European market. The bigger international carriers are performing much better than the low fare airlines except Southwest Airlines, which is a low fare airline. First, Delta acquired Northwest airlines, in result to that, it has the largest, and the most state of the art fleet in the US Aviation industry.? Secondly, United Continental after their merge it has the most routes, in fact as recently my trip to Tokyo, Japan I have noticed United Continental second biggest hub is Tokyo. In addition, the Eastern Region Marketing Manager Ms. Monica from United Continental have confirmed that they have more flights in operating in that region than Japan Airlines, Tokyo- Singapore, Tokyo- Guam, Ho Chi Minh City. US airways and American Airlines who are lagging behind with the

big players are soon likely to merge which will make create competition for Delta and United Continental, this might even increase the fares for the passengers.

For the low fare airlines like JetBlue, that has a good reputation and outstanding service has lower revenues than Southwest because of its network and routes. JetBlue does not have too many routes and destinations for its passengers whereas Southwest provides an alternate route (airport) in that same city for a lower price. For Example: Instead of flying from JFK New York- Chicago O Hare International Airport, Southwest flies from New York?s LaGuardia Airport to Chicago Midway Airport. In addition to that, they provide some benefits to their passengers like free baggage allowance and better legroom, which the big international carriers in the US do not provide. Air Canada, West Jet, Spirit Airways and Allegiant Airlines serves few destinations and with less destinations served less revenues earned and they are totally unable to match with their competitors.

?

??Strategic Options for an Economic Recession

?

Currently, the airline industry is facing financial crisis and many airlines are filing bankruptcy.

Some of the issues:

- Economies are slowing down in US, Japan, EU and China.

- There is overcapacity in many markets especially in the long haul markets; it is because due to reregulation and alliances when there is intensive competition.

- Rising demand of? low fare airlines

- Reconstructing the routes, whether the routes are profitable or not.

- Cutting costs and increasing the revenues.

Well, so far these three airlines are not facing anything like or in a mood to set things in that way. It all depends in the future if the countries or cities are dried with their oil money.

HUBS

?

?

London Heathrow?s terminal 5 is one of the amazing and biggest airport terminal in the world but just after six months Dubai airport Terminal 3 was opened and it has almost in third position in annual passenger handling. Both terminals can handle almost 30 million passengers a year and both of them were designed for the exclusive use for serving their flag carriers. Unfortunately, this is where the similarities end because London?s Terminal 5 is kind of cramped site, whereas Dubai?s T3 has 3 times more space; on the other hand Terminal 5 of London Heathrow would not get any bigger, Dubai?s Terminal 3 will soon be the largest building in the world by floor space. It will handle more than 43 million passengers a year and can accommodate 23 Airbus A380s (?Aviation in the Gulf?, 2010).

As years will, pass Dubai International Airport will be third busiest international airport and as passenger growth running a rate of 20%, the capacity will reach to 90 million passengers a year. It is only a matter of time that Dubai International airport will overcome London. Similarly, Abu Dhabi International Airport has claimed 21.2% increase in passenger traffic in 2012. In this year (2012) between the months of January and March, the airport has welcomed 29,123 flights and passenger traffic reaching to 15,197,000, which is almost a 22% increase. According to 2010, Skytrax, Qatar?s Doha International airport is 27th busiest airport in the world and the passenger traffic has been 15,108,521 compared to 13,113,224 in 2009 that is a 19% increase. By 2013, a new phase of Doha International airport will be opened which will be able to handle more than 16 million passengers (?Aviation in the Gulf?, 2010).

?

?

?

SWOT ANALYSIS FOR

EMIRATES, ETIHAD & QATAR AIRWAYS

| STRENGTHS

| WEAKNESS

? |

| OPPORTUNITIES

? | THREATS

|

CONCLUSIONS

From analyzing all the factors internally and externally it is worth that Emirate, Etihad and Qatar Airways management identify its capabilities and competitive advantages and makes a proper way to use those resources in the field.? From these analyses, one can say that Emirates, Etihad and Qatar need to respond to the changes in the economic conditions. Management needs to be aware of those situations and plan accordingly (Adam Schreck, 2012). Another factor to survive in this current financial crisis; these three airlines needs to outsource some of its operations in the value chain such as Engineering, Maintenance, catering and ground handling. This will surely reduce some costs of the company and they will benefit from high expertise and efficiency. Emirates, Etihad and Qatar Airways also need to strategize its prices and penetrate into the low cost markets as passengers are looking for low fares and better services. So far, these airline companies have a great potential and prospects, they have been awarded in numerous occasions.? All of them can gain from its marketing benefits and network to spread and reduce competition (Adam Schreck, 2012).

?

SOURCES

?

?

- Brueckner, J.K., ?The Economics of International Codesharing: An

Analysis of AirlineAlliances,? International Journal of Industrial

Organization19, 1475-1498(2001).

?

?

- Emirates Airlines, n.d. Emirates? Story; Fleet; Chauffeur Drive;

Emirates? Experience, Emirates News, retrieved: 2000/2004/2009/2012,

<www.emirates.com>

?

- Borenstein, S., ?The Evolution of U.S. Airline Competition,? Journal

of Economic Perspectives6, 45-73 (1992).

?

?

?

?

?

?

?

?

?

?

?

?

- Wensveen, J. (2007).Air Transportation: A Management Perspective (6th Edition). Burlington, VT. Ashgate

?

?

?

?

Like this:

Loading...

dark knight rises Aurora shooting James Eagan Holmes jeremy lin Sage Stallone Mermaid Body Found Celeste Holm

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.